Not a hint of disclosure despite $143,908 dollars worth of prior funding.

A few weeks ago, huge headlines were made by a paper from Marshall Burke (Stanford), Solomon M. Hsiang (Stanford) and Edward Miguel (Berkeley) about the impact of warming temperatures on the global economy.

Here is a sample of the sort of headline the paper generated (this one from Bloomberg News):

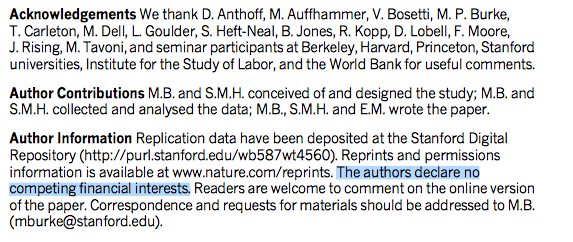

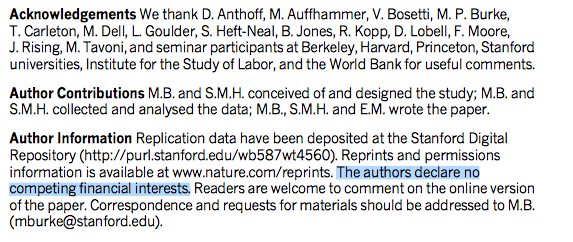

The study authors declared “no competing financial interests” in the study.

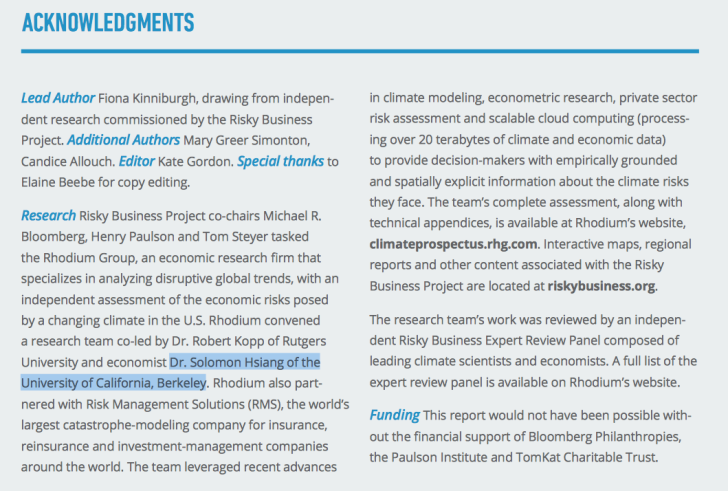

But in Solomon Hsiang’s resume (online here), he reveals that he was paid $143,908 for something called “Econometric assessment of climate change impacts in the USA.”

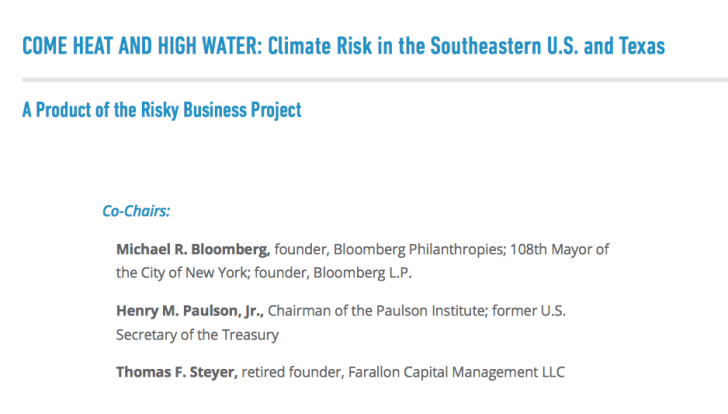

The other name for that work resulted in this July 2015 report from the so-called Risky Business Project:

The Risky Business Project is a climate advocacy group funded by green billionaires Tom Steyer and Michael Bloomberg, and near-billionaire and former Bush Treasury Secretary and Goldman Sachs CEO, Hank Paulson.

Here is the credit given by the Risky Business project to Hsiang.

Now, let’s back to the Nature paper and Hsiang’s disclosure (or lack thereof):

We are filing a complaint with the Nature editors, requesting a correction of the disclosure.

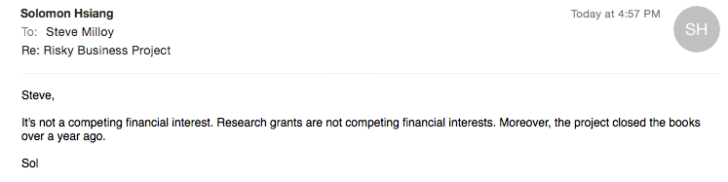

I contacted Hsiang by e-mail. This was his response.

Whose responsibility is it to ‘fact check’ the disclosure statements, and to take appropriate action when such a statement has been demonstrated to be disingenuous or outright mendacious?

So he got a paycheck from writing the “report” for the Green blob (economic think tank?) and decided it was good enough that he could should get academic credit if he submitted it to a “major journal”. Why not – the world is going to burn up by 2100, so get your money and creds while you can use them.

When will Retraction Watch dig into it?

Maurizio Morabito seems to have identified the real problem!

Hsiang is not well informed.

http://www.nature.com/authors/policies/competing.html

》》》For the purposes of this statement, competing interests are defined as those of a financial nature that, through their potential influence on behaviour or content or from perception of such potential influences, could undermine the objectivity, integrity or perceived value of a publication.

They can include any of the following:

Funding: Research support (including salaries, equipment, supplies, reimbursement for attending symposia, and other expenses) by organizations that may gain or lose financially through this publication.

Employment: Recent (while engaged in the research project), present or anticipated employment by any organization that may gain or lose financially through this publication.

Personal financial interests: Stocks or shares in companies that may gain or lose financially through publication; consultation fees or other forms of remuneration from organizations that may gain or lose financially; patents or patent applications whose value may be affected by publication.

It is difficult to specify a threshold at which a financial interest becomes significant, but note that many US universities require faculty members to disclose interests exceeding $10,000 or 5% equity in a company (see, for example, B. Lo et al. New Engl. J. Med. 343, 1616-1620; 2000). Any such figure is necessarily arbitrary, so we offer as one possible practical alternative guideline: “Any undeclared competing financial interests that could embarrass you were they to become publicly known after your work was published.”

We do not consider diversified mutual funds or investment trusts to constitute a competing financial interest 《《《