We report you decide.

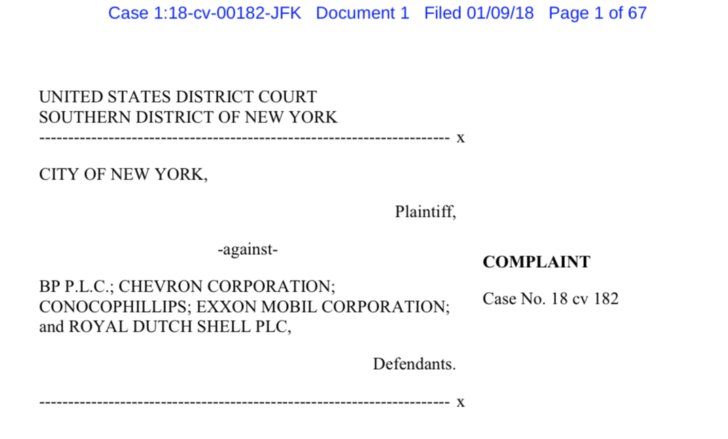

New York City recently filed a lawsuit against Big Oil alleging among other things that Big Oil knew about climate change and downplayed the threat.

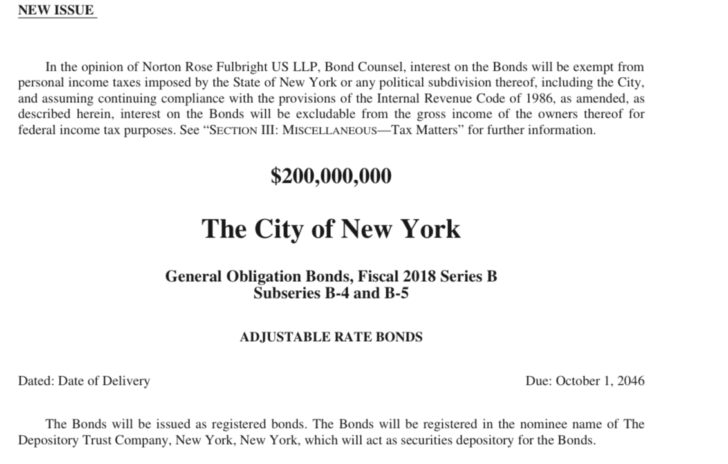

Interestingly last September, New York City sold $200 million worth of bonds in this offering.

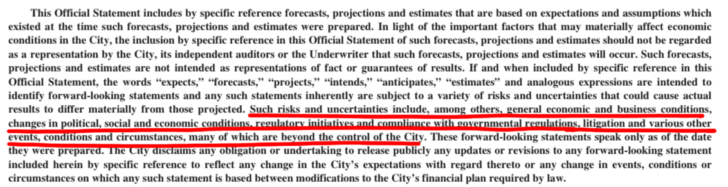

Keeping in mind that New York City is suing Big Oil for downplaying the risk of climate change, what exactly did the City tell its bond buyers about the risks of climate change? Here’s the excerpt:

So New York City disclosed nothing to its bond buyers about the risk of climate change in this document. In fact, the word “climate” does not even appear in this Official Statement.

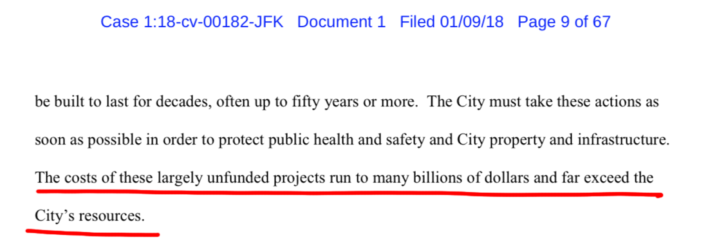

This is odd since the lawsuit states that climate damages will cost the city more money (“many billions of dollars”) than it can afford.

So is climate change important to New York City when it’s trying to shake down Big Oil, but not when it’s trying to shake down investors?

Our securities laws and regulations are based on two principles: 1) disclosure (of all material information) and 2) prevention of fraud (often caused by failure to do #1). If New York City hasn’t committed securities fraud, then it has filed a frivolous, if not fraudulent, lawsuit. It’s one or the other. There is no third alternative.

Some New York City bond disclosures do mention climate. But not this one. This one does refer to “Environmental Matters” in an ongoing disclosure document.

But we have not been able to find that document.

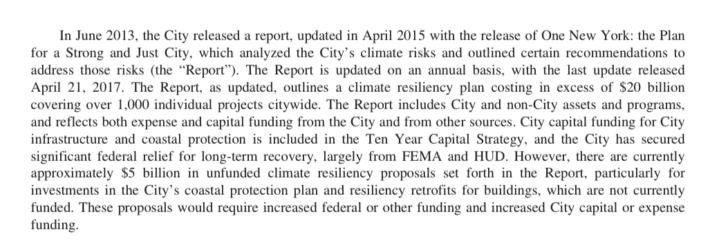

Other New York City bond documents (like this one) contain the following climate disclosure:

Let us know if you find anything.