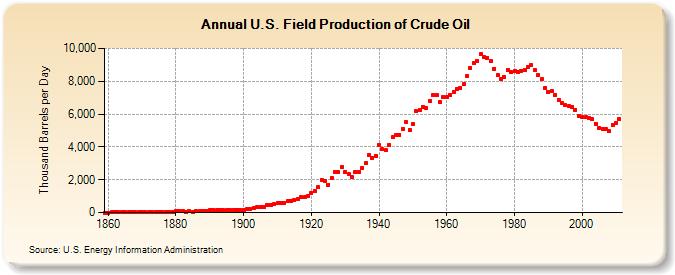

A silly, Obama-friendly correlative study looking at drilling/gas prices since 1975 — about the time U.S. oil production began to tank.

The Associated Press reports:

It’s the political cure-all for high gas prices: Drill here, drill now. But more U.S. drilling has not changed how deeply the gas pump drills into your wallet, math and history show.

A statistical analysis of 36 years of monthly, inflation-adjusted gasoline prices and U.S. domestic oil production by The Associated Press shows no statistical correlation between how much oil comes out of U.S. wells and the price at the pump.

If more domestic oil drilling worked as politicians say, you’d now be paying about $2 a gallon for gasoline. Instead, you’re paying the highest prices ever for March.

Political rhetoric about the blame over gas prices and the power to change them , whether Republican claims now or Democrats’ charges four years ago , is not supported by cold, hard figures. And that’s especially true about oil drilling in the U.S. More oil production in the United States does not mean consistently lower prices at the pump.

Sometimes prices increase as American drilling ramps up. That’s what has happened in the past three years. Since February 2009, U.S. oil production has increased 15 percent when seasonally adjusted. Prices in those three years went from $2.07 per gallon to $3.58. It was a case of drilling more and paying much more.

U.S. oil production is back to the same level it was in March 2003, when gas cost $2.10 per gallon when adjusted for inflation. But that’s not what prices are now…

Sounds just like O’Reilly whining that there are more rigs drilling now yet gas prices are high. Has it not occurred to these “brilliant” commentators that the increase in operating drill rig numbers is because oil prices are high?

Edward and DP both hit it on the head. Absolutely Pathetic News (AP) is an egregious offender of fact and has been for decades. But then who ya gonna believe – AP or your lying econ courses? [actually then may have unintentionally been two negative choices, I suppose it depends on whether or not you were schooled on Keynes and Samuelson or Friedman and Stigler]

Well that’s on half of the supply and demand dynamic. The AP gets an F for its 50% score.

AP carries a lot of water for Obama. Are they “Jack” and OWN “Jill”?

I need to do a better job proofiing, sorry.

Great job by the AP in doing an apples and turnips comparison. The White House should put change machine in the AP national hq so every time these 2 bit horrors right a fluff piece like this one Obama can get change back. As most congenital idiots are aware the price of oil is set on the international market but apparently this escapses the AP. When the futures market looks at capacity and capability they see the anti-growth regulations and hostility towards fossil fuels predominant in the American left. Increasingly over the years the domestic oil industry has been virtually shut down by the zero growth fanatics of the left. The DOE and the EPA are even trying to find a way to shut down North Dakota fields that are on private property. This negative and hostile attitude from Washington has a direct impact on prices here in the country. Their strategy is shortages and rationing through suppression of exploration and production via regulations. A first semester economics student realizes that short supply equals higher prices equals increased short term production for greater profits while not having a meaningful impact on world supply. A comprehensive energy plan based on maximising domestic oil production, converting where possible to natural gas and adding 20 new nuclear power plants every 5 years will cause the price of oil to plummet. Converting 20 or 30 million homes in the frost belt to electric heat from oil will reduce green house gases by a significant amount and remove the need for economy crushing regulations from the anti-human lobby. The democrats and the American left fear what they cannot control. Obama’s election gave them hope for controlling the American people through regulation and executive orders. As Obama’s re-election becomes more and more questionable by the day, the strident tone of the media is becoming almost apolplectic in their dismay that the American people just refuse to listen to and heed suicidal economic advice from the myopic minions of the left.

What we are seeing in the production curve looks more like it is tracking the interplay between *producible* resources and production technology, which got a recent jolt from fracking.

The price curve tracks geopolitics.