A new report from the Electric Power Research Institute (EPRI) buries net zero. Investment managers, public traded companies, regulators, politicians and more who have so far talked very loosely about net zero should now be on notice that they are talking about pure fantasy, if not falsehood. For investment managers and public-traded companies net zero is false and misleading and should have legal ramifications.

‘Net zero’ is a climate activist goal to get manmade emissions down to net zero on a net basis. It doesn’t mean no emissions, it just means whatever CO2 emissions occur are entirely offset via manmade or natural CO2 capture.

‘Net zero’ has become part and parcel of the so-called ESG movement, with investment managers beating on CEOs to have plans for reaching net zero. But that should all be over and done with now. EPRI has issued a report that puts an end the net zero fantasy.

Now you can read the whole report if you want, but you only need to read the following.

We’ll start at the conclusion. It states:

… this study shows that clean electricity plus direct electrification and efficiency… are not sufficient by themselves to achieve net-zero economy-wide emissions.”

Read it for yourself:

So that means that all the expensive wind, solar, batteries, and energy-efficient lightbulbs and appliances don’t get you to zero emissions. I have already discussed elsewhere the fantasy of utility-scale carbon capture.

But it gets worse. Going back to the beginning of the report, we find that EPRI didn’t even consider:

- Supply chain constraints (like all the minerals and metals needed for wind, solar, batteries and other “green” technology, many of which would have to come from China)

- Whether a net-zero grid would work (i.e., be “operationally reliable and resilient”).

Once again, read it for yourself:

So here we have the electric utility industry itself saying it can’t make net-zero happen, even without considering whether the resources are available or whether the system would work.

It’s reasonable to conclude that BlackRock and other net zero pushers have either absolutely no idea what they are pushing or are knowingly pushing something that has no possibility of working. The utilities seem to know better but they don’t seem to care.

And it gets even worse.

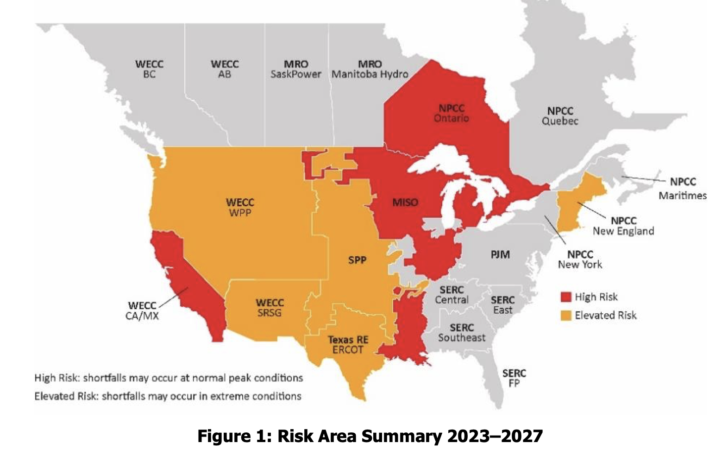

Just last week, the regulatory body known as the North American Energy Reliability Council (NERC) issued a report on the state of our electricity grid.

It reports that most of the US is under elevated- to extreme-risk of power failure under extreme weather conditions between now and 2027.

Not only are we dismantling reliable baseload power (coal, natural gas and nuclear plants), the grid is simultaneously being burdened with more demand from EVs and other electrification.

This is a disaster in the making. Unless stopped, net zero will turn out to be a catastrophic lie. You heard it here first.

”If you can’t dazzle them with [actual] science. you can always baffle them [& yourself] with BS……

So much easier than getting a basic grip on thermodynamic reality………..

Rather than rationing fossil fuels at a reasonable level, the kleptokrats can of course dominate the plebs by making all kinds of rules & regulations…..

we had several studies some years back from engineers and scientists in the materials and electricity industries that showed this whole CO2 thing is stuff and nonsense and that there is no reasonable path to full-on “green” energy other than massive build out of nuclear plants (… maybe) which still does not take care of aviation and ships among others.

IMAO this whole ‘green’ energy and CO2 crusade is merely a scam to enrich the kleptocrats and their buddies while causing pain and restrictions on the population.