The Nature Conservancy has been caught by Bloomberg News selling phony carbon offsets to at least J.P. Morgan Chase, Disney and Blackrock, which have wrongly touted the bogus offsets purchased. Below is my letter to the Climate Task Force of the U.S. Securities and Exchange Commission’s Division of Enforcement.

Dear Ms. Kelly L. Gibson, Chairman, SEC Climate Task Force

I am writing to request that you investigate the false and misleading touting of carbon offsets by SEC registrants J.P. Morgan Chase, Disney and Blackrock.

As reported by Bloomberg News, the Nature Conservancy has been selling phony carbon offset credits to the above mentioned companies and the companies have been, in turn, falsely touting them. Here is a 2020 example by Disney.

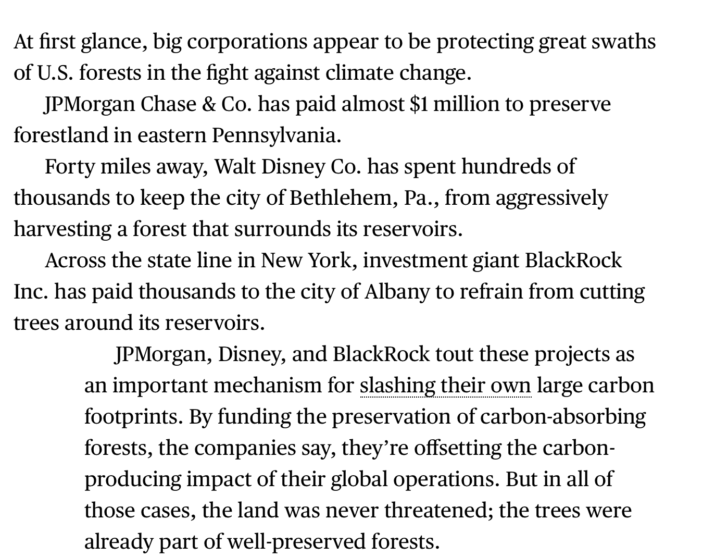

As recounted by Bloomberg:

There is a very good possibility that many more registrants are also touting bogus carbon offsets related to the Nature Conservancy and other offset sellers.

The SEC Climate Task Force should investigate carbon offsets generally as they are more likely to be false and misleading than of any value to the climate.

You may recall, I have previously petitioned the SEC to take action to rein in the out-of-control false and misleading climate-related statements made by registrants.

I look forward to your response.

Sincerely,

Steve Milloy

Related reading:

- A Top U.S. Seller of Carbon Offsets Starts Investigating Its Own Projects (PDF), Bloomberg.com, April 5, 2021

- These Trees Are Not What They Seem (PDF), Bloomberg.com, December 9, 2020

- SEC announces Climate Task Force to punish climate lying, JunkScience.com, March 2021

- 10 myths about net zero targets and carbon offsetting, busted