ExxonMobil lawyer to management: “As stupid as they appear, they’re actually very good at paperwork” [quote from Old School, click the image to watch the clip].

Every year, the ExxonMobil annual shareholder meeting is a global warming circus. Communists, masquerading as hysterical climate bedwetters and ironically led by the Rockefellers themselves, file shareholder proposals providing them opportunities to pressure and rail against corporate management. During the period of global warming hysteria and as the largest and most prominent oil company, much media attention and street theater has accompanied the ExxonMobil’s annual shareholder meeting.

Under federal securities regulations, shareholder proposals must be included in the company’s annual proxy statement (mailed to all shareholders) — unless the company receives permission from the U.S. Securities and Exchange Commission (SEC) to exclude the proposal from its proxy statement. This permission may be granted in the form of a so-called “no action” letter. If a corporation doesn’t want to deal with the shareholder proposal, it can ask the SEC for permission to exclude it. If granted, the SEC gives the company a no-action letter, saying it will not take enforcement action against the company for excluding the proposal. Every proposal included in the proxy statement is presented at the meeting by its proponent and the results of the vote are announced.

So last December, in a bid to save ExxonMobil from global warming activists masquerading as shareholders, I filed with ExxonMobil the shareholder proposal to end all shareholder proposals. My shareholder proposal, if implemented, would block nuisance shareholders from submitting ridiculous (i.e., global warming-related) proposals, thereby reducing the circus nature of the annual shareholder meeting. Despite SEC rules concerning shareholder proposals, state corporate laws allow corporations to change their by-laws to not have to accept shareholder proposals.

Here is my proposal:

Nuisance Shareholders

Resolved:

That the Company amend its bylaws to no longer permit shareholders to submit precatory (non-binding or advisory) proposals for consideration at annual shareholder meetings, unless the board of directors takes specific action to approve submission of such proposals.

Supporting Statement:

Stock ownership has become politicized. Many shareholders own stock in publicly-owned corporations for the sole purpose of advancing the shareholders’ own social or political agendas, while simultaneously assailing the corporations’ legitimate business operations. These activist shareholders are “nuisance shareholders.”

A primary tool of nuisance shareholders is the submission of non-binding precatory (advisory) proposals for discussion and vote at annual meetings of shareholders. Proposals from nuisance shareholders can coerce management into making decisions not in the best interests of the Company and its bona fide shareholders, and turn the annual meeting into a media-activist circus.

Last year, activist and nuisance shareholders submitted 11 precatory proposals requesting the Company take certain actions pertaining to corporate governance, compensation, lobbying, employment policy and environmental policies and practices.

The overarching purpose of these proposals is to harass and intimidate the Company into actions that it would not normally undertake and that, in fact, may be harmful to the company and its bona fide shareholders.

As Nobel laureate Milton Friedman wrote, “The social responsibility of business is to increase its profits.” Businesses accomplish this vital role by providing the goods and services that society needs and wants in compliance with the law.

Businesses are society’s wealth generators. This wealth fuels the rest of society via salaries, taxes, dividends, and stock price appreciation. Businesses should not be distracted and hijacked by social and political activists seeking to change perceived shortcomings of society, which are issues better and more appropriately managed by governments and charities.

Nuisance shareholders and their proposals distract Company management and coerce company leadership into taking harmful actions based on dubious political correctness rather than rational business practice. This can only reduce profits and, thereby, prevent business from achieving its actual social responsibility.

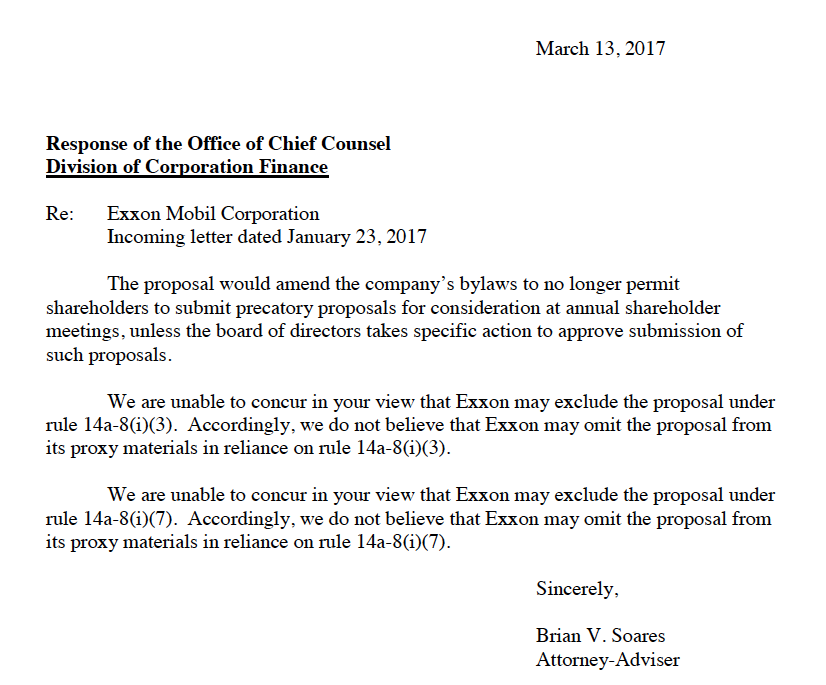

Now you might think ExxonMobil management would happily accept my proposal in order to save itself from the climate crazies. But you’d be wrong. In fact, ExxonMobil asked the SEC for permission to exclude my proposal. In January, it commissioned the tony, white shoe law firm of Davis Polk & Wardwell to ask the SEC for a no-action letter — a 5-page letter with 20 pages of exhibits. I responded in early February with a succinct one-page letter countering Davis Polk’s point.

Li’l ol’ me won, which brought to mind the aforementioned clip from the Will Ferrell/Luke Wilson/Vince Vaughn movie, Old School. You can just imagine the Davis Polk lawyer breaking the news to ExxonMobil’s management: “As stupid as they appear, they’re actually very good at paperwork”.

So I will be at the ExxonMobil annual shareholder meeting defending the company from not only the global warming activists but, apparently, from ExxonMobil management itself.

When I managed the Free Enterprise Action in 2008, I tried to do the same thing. Here’s the YouTube audio clip of my proposal presentation — and the THUNDEROUS ovation I received afterward. By the way, that’s then ExXonMobil CEO Rex Tillerson (now Secretary of State) introducing me.

So stay tuned.

It’s a sorry state of affairs when you have to save them from themselves.

Good on you. And good luck. Great work you’re doing.

I love it. Good for you! Do the same for Altria and Philip Morris too — who also receive and print what’s clearly nothing but anti-smoker activist proposals from “stockholders” who own just enough shares to be able to do it.

I hope it goes to court. Discovery will be a real eye opener.

Apparently there are people trying to sue Exxon Mobil for climate change denial. ha.

They say its like the tobacco industry case. I seem to remember those cases bizarrely refused to admit any scientific evidence. So perhaps these climate change cases will be the same. ha.

Way to go, Junkman!

Makes you wonder who is running Exxon.